Early Bird

Change in calculation Colorado withholding-tax calculation

Beginning this year, the Department of Revenue has required all employers to begin using the flat-deduction method.

By Tessa Heyes

March 25, 2021

The Colorado Department of Revenue revised its state-income-tax-withholding methodology as a result of changes in the IRS Federal W-4 form, which eliminated withholding based on personal allowances. Beginning this year, the DOR has required all Colorado employers to cease using the personal-allowances method and begin using the flat-deduction method on state-income-tax withholdings.

This new flat deduction amount is based on your filing status:

- Those with Married Filing Jointly status on their W-4 form have a flat deduction amount of $8,000 per year.

- All other statuses have a flat deduction amount of $4,000 per year.

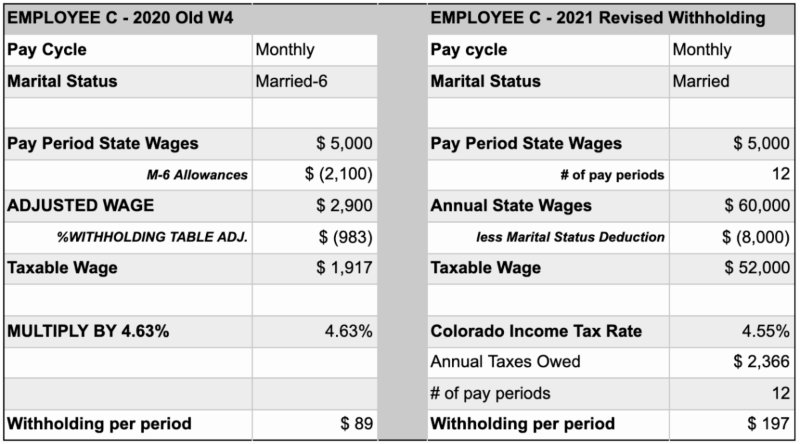

Employees could previously adjust their state-tax withholding by changing the number of personal allowances they claimed on their W-4. This is no longer possible with the DOR’s revised state-withholding methodology. It is possible that your state-tax-withholding amount has increased as a result of the calculation change, particularly if you had claimed three or more personal allowances on your W-4 in previous years. The change in withholding methodology has not affected your tax liability, which is based on your Colorado taxable income; however, beginning this past January, the state-income-tax rate changed from 4.63% to 4.55%.

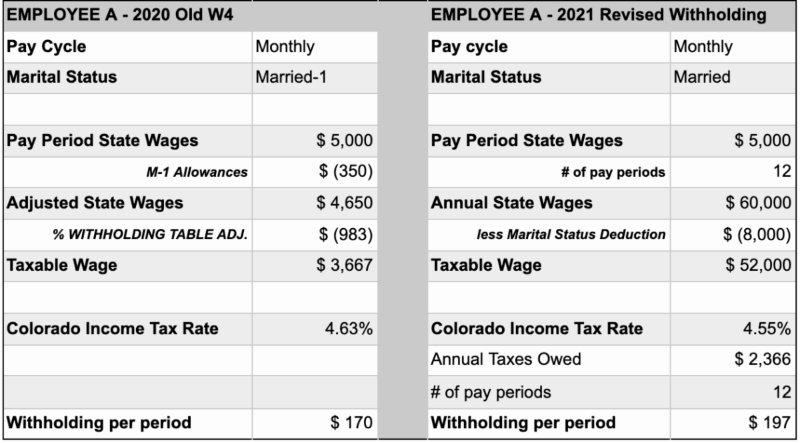

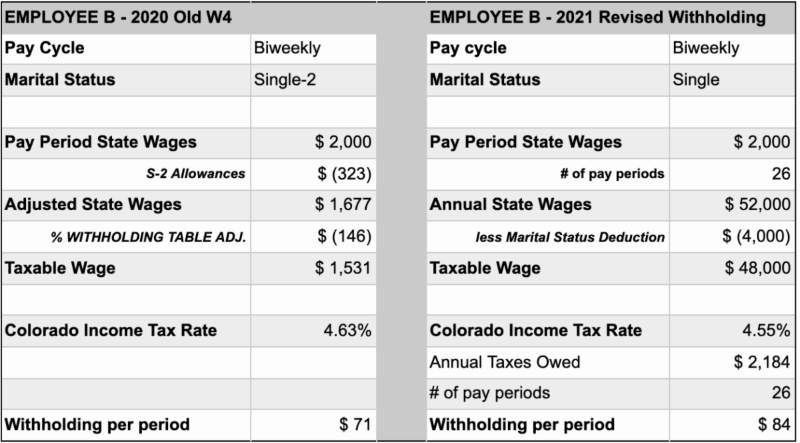

Below are examples of how the new withholding methodology would affect paychecks. If you have more questions on the withholding process, please visit the DOR’s website.

Revised withholding by the DOR – examples

Here are three sets of examples to show the difference in calculation methods referenced in the “Revised Withholding by DOR” from above. On the left side is the old withholding method, and on the right side is the new flat-deduction method. With the 2021 revised withholding on the right side, you will notice that the withholding amount is higher than the left side with the old withholding method.

Topics: Benefits, Compensation, Human Resources

Edit this page